Automotive Aftermarket Insurance

RevPro® is the authority in automotive aftermarket insurance. Our team has built a top-rated custom insurance and risk management program specifically for the automotive aftermarket industry. We’re industry insiders and the only insurance broker with the SEMA and PRI stamp of approval.

That’s insurance accelerated.

Automotive Aftermarket Insurance Specialists

Insurance Accelerated

We understand our clients’ business and act as an extension of their risk management and finance teams. This unparalleled knowledge and understanding gives us the power and advantage to help clients in the automotive aftermarket industry advance their goals, outpace competitors, and achieve faster, more efficient risk management and insurance solutions. With our guidance, clients can transform their insurance and risk management program into a strategic resource with measurable outcomes. We get it. Insurance is often viewed as an unavoidable business expense, but when used strategically, our clients can stand out from their competitors to win more business. Insurance Accelerated is about going from cost to value, moving beyond traditional insurance concerns, and helping our clients evolve.

Who We Serve

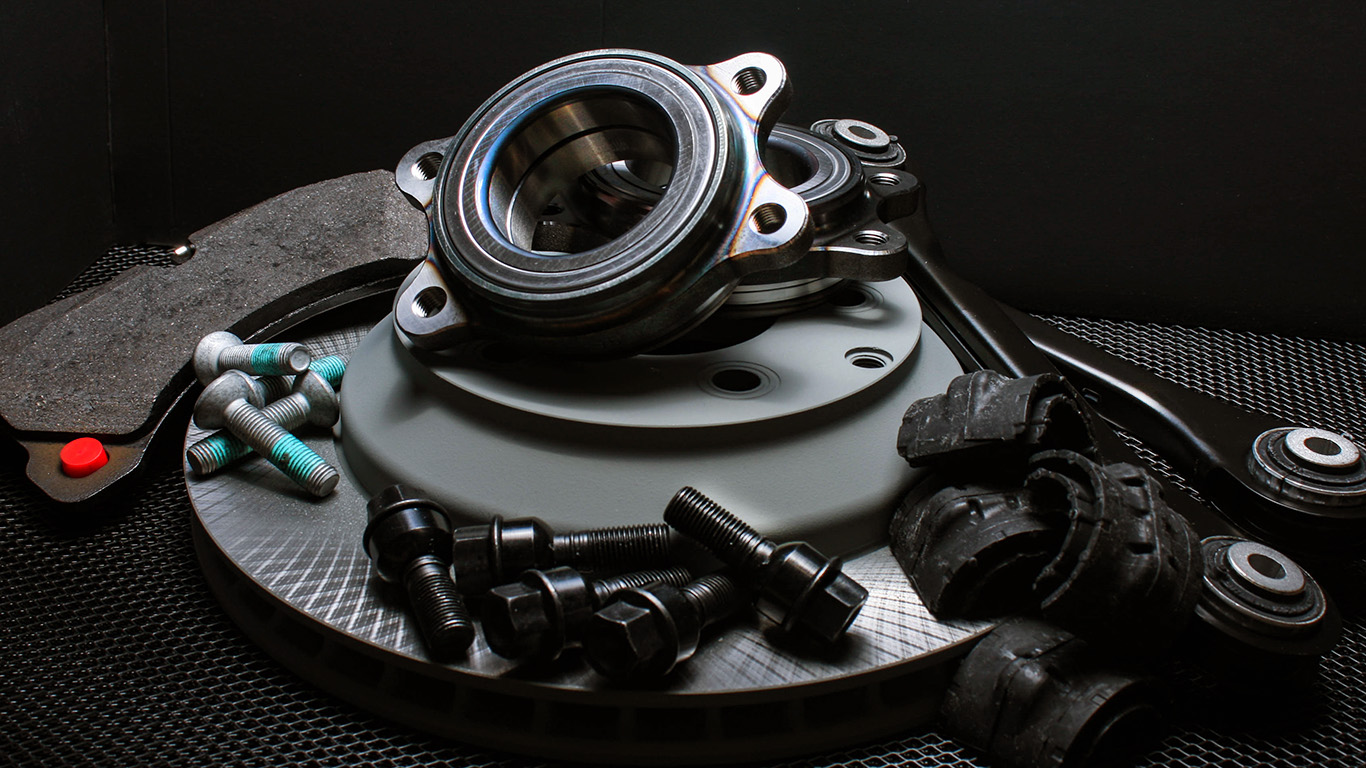

RevPro has built a portfolio of proprietary insurance programs to protect auto part manufacturers, auto parts distributors, auto parts retailers and auto parts installers against the unique risks they face every day. Our exclusive business insurance program is specifically built for the automotive aftermarket industry. Our buying power offers comprehensive insurance at reduced costs, effective and efficient underwriting considerations and strong carrier relationships. Our coverages include:

- Auto Manufacturers Insurance & Distributors Liability

- Auto Property Damage Coverage

- Auto Product Liability & Auto Recall

- Cyber Liability Insurance

- Garage & Shop Insurance

Trusted Partner: SEMA & PRI Authorized

The Specialty Equipment Market Association (SEMA) and Performance Racing Industry (PRI) have named RevPro as the authorized broker for more than 30 years. Our SEMA and PRI stamp of approval accelerate our ability to serve businesses in all 50 states thanks to the only dedicated aftermarket insurance program in the country. RevPro offers dedicated SEMA and PRI insurance products as an extension of SEMA’s member services. Visit the SEMA membership page for more information about our partnership:

Learn MoreCoverages

Additional Coverage Options

RevPro clients are also able to obtain additional coverage options through Alliant Insurance Services which include:

For companies located in the states of OH, WA, ND and WY workers' compensation is provided through state mandated providers. For all other states, employers can decide which insurance company they want to purchase their coverage from.

The insurance landscape can be quite competitive. Many carriers have filed rates that may aggressively price coverage and safety services should not be assumed. At Alliant, our goal is to work with our exclusive carrier and those competitive carriers who have a strong appetite to afford coverage and service to all aspects of the automotive industry

Our Auto Workers' Compensation Services

Work exclusively with a carrier partner dedicated to the automotive industry for your employer’s liability

- Efficiently manage claims to ensure early return to work.

- Be an employer advocate to ensure claims history has a positive effect on a companies experience modification factor.

- Design and deploy safety programs designed to lower the risk of work-related injuries.

Your company needs a cyber solution that was built for the automotive aftermarket industry. RevPro provides you with the right coverages that can keep your business up and running in the event of a cyberattack or other data breach.

Your go-to resource in all things safety support designed to mitigate claims origination.

- Online Resources

- Free Safety Evaluation

- Safety Training and Materials

- OSHA Defense

- Live Safety Webinars

As an employer in the automotive industry, you need a benefits partner that can deliver a dynamic, comprehensive program that meets your employees’ needs while staying cost-effective for your business.

In the fast-paced world of the automotive industry, your employees deserve a benefits plan that keeps up. At RevPro, we understand your unique needs, which is why we’ve teamed up with BCI Insurance Solutions, part of the Alliant company, to deliver top-tier employee benefits. BCI’s vast experience in benefits, combined with our industry insight, means you get a plan that works for your people—and your bottom line. You can rely on the expert counsel, superior service, partnership, and trust provided by BCI Insurance Solutions to match your company with the appropriate coverage in these essential areas:

For Groups:

- Medical

- Dental

- Vision

- Long-term disability

- Short-term disability

- Life

- Other voluntary products (employee-paid)

- COBRA services

- Section 125 services

Get in touch today to discover how RevPro and BCI Insurance Solutions can craft a benefits solution that drives value for your business.

We understand that the performance of your business depends on the performance of your people. We have responded with a comprehensive human resources (HR) services package to power your business.

ManageEase is a single source for all your human resources needs. ManageEase can help you address potential HR related issues before they develop into problems and assist in responding to those crises that occur. Their goal is to help you reduce or eliminate the human resources risks inherent in today's employment environment.

ManageEase offerings include:

- HR On-Call

- HR Alerts and Notices

- Quarterly Webinars

- Compensation Reports

- 2024 Annual Regulatory HR Guide

For more information, contact us.

LifeBalance is an exclusive perk for RevPro clients and their employees.

Provided at no cost to all employers using RevPro, LifeBalance offers comprehensive employee discounts to your team on automotive care, family activities, travel, fitness, electronics, apparel, outdoor adventures and more.

Additionally, your employees will earn access to deals on auto insurance, meal delivery, childcare, eyewear, pet insurance and other valuable goods and services. Discounts are available to all employees of RevPro clients and their household family members.

Click here to view a selection of LifeBalance discounts.

InsureOne Premier

Dedicated personal lines products and services for those organizations needing help with homeowners, personal and collector autos, boats, RV’s and more. InsureOne’s white glove service extends to all 50 states and the services involve do the shopping for you.

In some circumstances, leases, contracts, or other business relationships require limits of coverage greater than $1,000,000. In those circumstances, excess and or umbrella liability policies can be made available to increase the limit of coverage over the following underlying policies:

- General Liability (Including Product Liability)

- Auto Liability (Autos used in the business)

- Employers Liability

Thanks for your message.

We’ll be in touch shortly.

Thanks for your message.

We’ll be in touch shortly.