Property Damage Liability Insurance

Property damage liability insurance protects your business from financial loss. It is one of the most important investments to ensure the future of your business. RevPro® can provide the coverage you need.

Thanks for your message.

We’ll be in touch shortly.

Property Damage Insurance Keeps You in Business

When disaster strikes your business, whether you are a manufacturer, wholesaler, retailer, or installer/jobber, property damage insurance becomes crucial. It not only replaces the property you own but, most importantly, keeps your business operational and running smoothly.

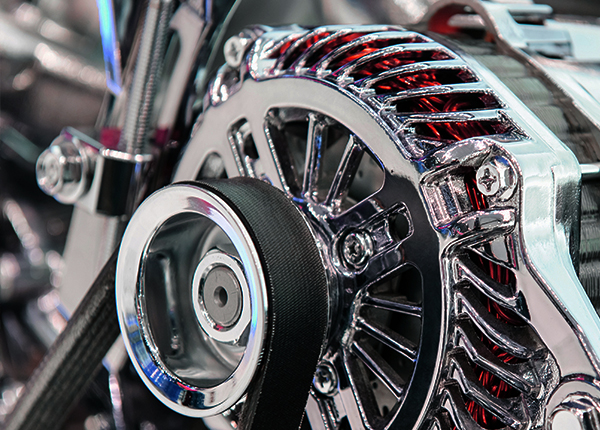

Customized Property Damage Insurance for Customized Vehicles

RevPro understands the importance of accurately appraising customized vehicles to ensure proper property damage insurance coverage. Our expert team evaluates your vehicle's value, considering all modifications, so you have peace of mind. With a policy aligned to your customized vehicle's true worth, you can drive with confidence and protection.

Property Damage Insurance that Evolves with You

Your automotive business is unique and constantly evolving, and at RevPro, we embrace that. Our specialty is providing tailored property damage liability insurance for the diverse risks you face. Working closely with you, our experienced team designs a comprehensive policy. With our flexible approach and industry expertise, you can trust that your business has the protection it needs to thrive in a dynamic market.

Property Damage Insurance to Close the Gaps

We ensure your property damage liability insurance includes any modifications, accessories, or custom equipment added to your vehicle. Since vehicles can depreciate rapidly, this may impact your bottom line. Unlike basic auto policies that usually cover physical damage based on the depreciated actual cash value, with RevPro, you can rely on comprehensive property damage coverage that considers your vehicle's true value.

Property Damage Liability Insurance

We understand the importance of safeguarding your property, and at RevPro, we are here to provide comprehensive property damage coverage tailored to your specific needs. Our expertise lies in protecting your valuable vehicles and ensuring that you have the right level of protection in place. Whether you own a fleet of cars, trucks, vans, or other vehicles, we have the solutions to cover your property with utmost care. Our coverages include:

- Your building – replacement cost limit to rebuild part of or all of your building structure to like kind and quality after a loss.

- Assorted business contents – fixtures, furnishings, raw materials, work in progress, finished goods/inventory, tools and equipment including customer goods.

- Business earnings – business interruption and extra expense coverage can provide lost profits and can include extra expenses incurred after a loss to maintain the business. Business Interruption is a subcomponent to a property policy, ensuring that you have financial support during periods of suspended operations.

- Property in transit – Goods and equipment in transit can be items being taken to a subcontractor for processing, inventory in an employee’s car or shipped via courier

- Equipment Breakdown – Provide much needed coverage for sudden and accidental breakdown of crucial equipment and provides replacement or repair, as well as loss of income and extra expenses.

- Crime coverage – From dishonest acts of an employee to counterfeit currency

Thanks for your message.

We’ll be in touch shortly.

Thanks for your message.

We’ll be in touch shortly.